Top Reasons Real Estate Investors Need a Financial Plan

Welcome to month four of our real estate newsletter mini-series! For the month of August, we are discussing how real estate fits into an asset allocation and what is the right amount of an exposure to have in your overall portfolio.

Is real estate correlated with the stock market?

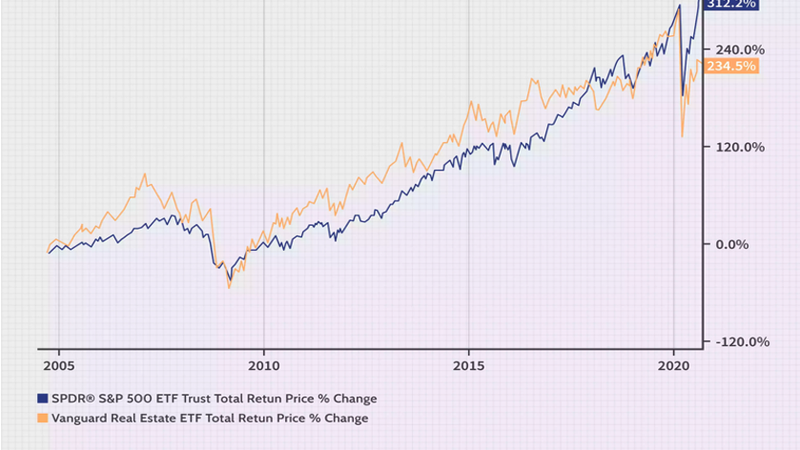

With the S&P 500 continually hitting all-time highs, investors are wondering if it makes sense to allocate capital outside the stock market. Real estate is a common first place to look for diversification. Real estate is often thought of as a way to diversify into a non-market correlated asset, but it isn’t as straight forward as many may think. There are many factors that go into comparing returns of real estate and the stock market. Investing in the stock market means you are purchasing shares of a publicly traded company. Investing in real estate usually means buying a physical asset (although there are other ways to gain exposure to real estate such as REITs – Real Estate Investment Trusts). Investopedia compared returns between the SPDR S&P 500 ETF (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) over the last 17 years and found that both real estate and stocks can take similar downturns during economic recessions.

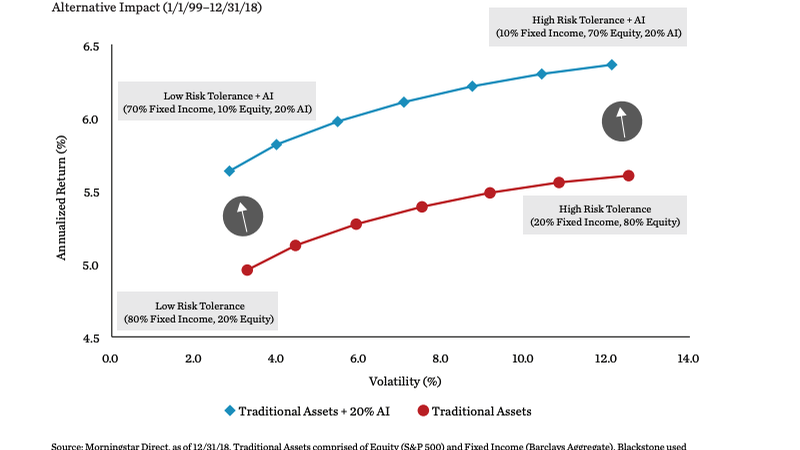

What may not be reflected here is the security of having strong passive income even in times of economic turmoil, and that is what keeps real estate investors coming back for more. Both real estate and stock market assets come with risks but can serve different purposes in an overall diversified portfolio. Research done by Blackstone has shown that an investment portfolio that allocates 20% to alternative investments can perform better than a portfolio invested in only traditional investments. Private real estate is one form of an alternative investment.

Diversification is important in investing as it is certainly possible to own too much real estate, especially if it’s not income producing. The right amount of real estate depends on the investor’s time horizon, risk tolerance, and overall liquidity need. Building a comprehensive financial plan with a firm that specializes in real estate modeling, like Colorado Wealth Group, will help you understand how owning real estate fits in to your goals and objectives.

Is equity in your residence a true asset?

Equity in a real estate property is the difference between property value and debt owed on the property. Often, equity in a primary home is the largest asset on an investors balance sheet. Home equity is not a liquid asset and tends to remain locked up over time. It is common to roll equity from one home purchase to the other. Equity in a primary home is usually not factored as an asset that is used for retirement unless a significant downsize is planned for later in life. Home equity can be leveraged to borrow money with tools like a Home Equity Line of Credit (HELOC) or Cash-Out Refinance; however, this creates more debt and adds a payment to your monthly budget. In today’s low interest rate environment, we are seeing clients utilizing these debt instruments to take equity out of their home without significantly increasing their monthly payments. This cash can be used to pay off other high interest debts, renovate the home, or get more money invested. Investors can increase their investment portfolio by achieving returns that are greater than the new interest rate. While it is important to keep building your liquid net worth for your long-term goals, be careful relying on equity in your primary home as a dependable asset you can bank on for retirement.

If you are interested in diving deeper into planning with real estate or would like to find out more information about Colorado Wealth Group, please browse through our website, www.coloradowealthgroup.com. Initial consults are always complimentary; make sure to let us know you found us by reading this blog!

Stay tuned for next month’s mini-series topic: Pros & Cons of Owning Investment Properties with an IRA.