Welcome to the inaugural Jay’s Corner, a blog where I will be discussing a range of investment topics, ideas, and current events. The goal of Jay’s Corner is to educate and provide financial tools for your financial toolbelt. Today’s financial tool is ongoing contributions. It may not sound like much, but consistent contributions to an investment account can create cascading effects that might be the difference between reaching your financial goals and exceeding them.

To illustrate the powerful tool that ongoing contributions can be, I’ve created a hypothetical scenario that we are going to walk through together.

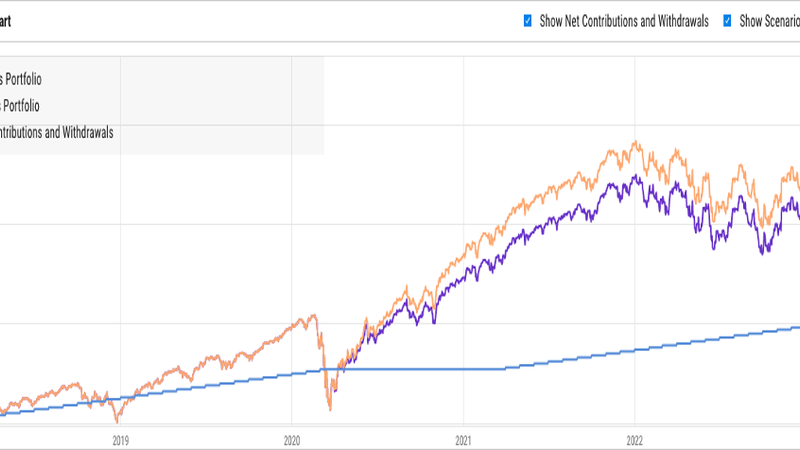

On January 1st 2018, two clients, Jacob and Steven, walk in to CWG HQ. Both Jacob and Steven want to immediately invest $100,000 into an aggressive strategy and start an ongoing contribution of $1,000 a month into their accounts. On March 13th 2020, Steven calls CWG and requests that his $1,000 a month contribution be stopped immediately due to uncertainty regarding the COVID 19 pandemic. One year later (March 13th 2021), Steven calls CWG and requests that his $1,000 a month contribution be started again. Over this same period, Jacob has continued to invest his $1,000 a month into his investment account. Five years after opening their accounts, the value of Jacob’s account is $218,332.43 and Steven’s account is $203,778.49. Jacob’s account is worth $14,553.94 more than Steven’s despite being invested in the same strategy, why is that?

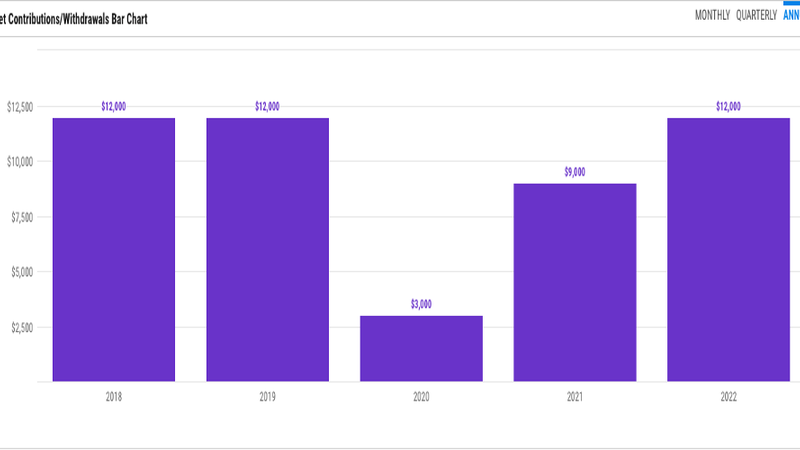

Well, some of that has to do with the fact that Jacob continued to contribute $1,000 a month between March 13th 2020 and March 13th 2021, while Steven stopped his contribution. Jacob contributed $1,000 a month, every month, for five years, so Jacob contributed $60,000 to his account over the 5 years. Steven contributed $48,000 over the course of the five years as illustrated below.

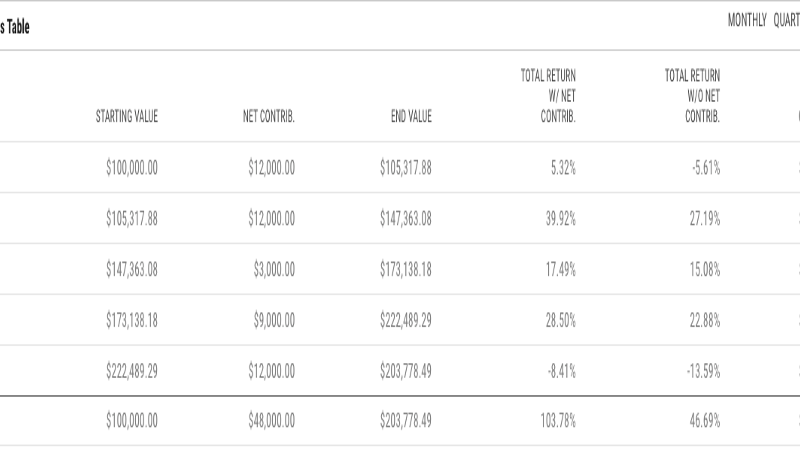

Before we dive into the effects of temporarily stopping a contribution, we should look at what kind of an effect Steven’s contributions had to the overall return of his portfolio.

These are the annual returns for Steven’s portfolio. Pay particular attention to the “Total Return w/ Net Contrib.” and “Total Return w/o Net Contrib.” columns. The Total Return w/o Net Contrib. column tells us what the return of the portfolio strategy was (46.69%). If Steven did not make any monthly contributions to his account and instead only invested the $100,000 on January 1st 2018, by December 31st 2022 the account value would be ~$146,690.

What is the effect of ongoing contributions for Steven’s portfolio? When Steven contributed to his account the value was $203,778.49 and the value if Steven didn’t contribute was $146,690. The difference is $57,088.49; however, $48,000 can be attributed to cash that was added to the strategy, so if we take out the contributions, we are left with $9,088.49. $9,088.49 is the amount of value that has been added to the portfolio by contributing. Expressed as a percentage, 4.46% of the current value of the portfolio can be attributed to making contributions.

Now let’s go back to the effects of temporarily stopping a contribution. Jacob’s portfolio was worth $14,553.94 more than Steven’s portfolio; however, $12,000 can be attributed to cash that was added to the strategy, so if we take out the contributions we are left with $2,553.94. $2,553.94 is the amount of value that has been added to the portfolio by consistently contributing. Expressed as a percentage, 1.17% of the current value of the portfolio can be attributed to making consistent contributions.

You may be thinking that $9,088.49 or $2,553.94 isn’t that significant, and it definitely won’t be the difference between meeting or exceeding financial goals. However, when you combine the effects of ongoing contributions with the most powerful tool in our toolbelt, things start to look a lot different. That most powerful tool being is compound returns, or as Einstein called them, “the 8th wonder of the world”. The actual quote was in reference to compound interest but works the same way.

To illustrate the effects of compound returns, let’s use some assumptions with which we are already familiar.

On December 31st 2022, the value of Jacob’s portfolio was $218,332.43, Steven’s was $203,778.49, and the portfolio with no contributions was $146,690.

We know that over the past 5 years the portfolio returned 46.69% with no contribution effects. We will assume that over the next 5 years the portfolios will return the same and we will not make any more contributions. On December 31st 2027, the value of Jacob’s portfolio will be $320,271.84, Steven’s portfolio $298,922.67, and the no contribution portfolio $215,179.56.

Five years later, the $9,088.49 turns into a difference of $35,743.11 and the $2,553.94 turns into a difference of $9,349.17. This effect will continue to expand as the years go on.

Contributions can have a huge impact on investment returns and realization of financial goals. In our example, Jacob was the star pupil making consistent contributions and was compensated well for it. While Steven did fall behind a bit relative to Jacob, he was also well compensated for his contributions.